Budget

Budget is a simplified accounting app designed to help you

manage your money.

Record your incomes and expenses, and

organise your funds into accounts.

Budget will analyse

your records and present useful accounting information to help

you make informed financial decisions.

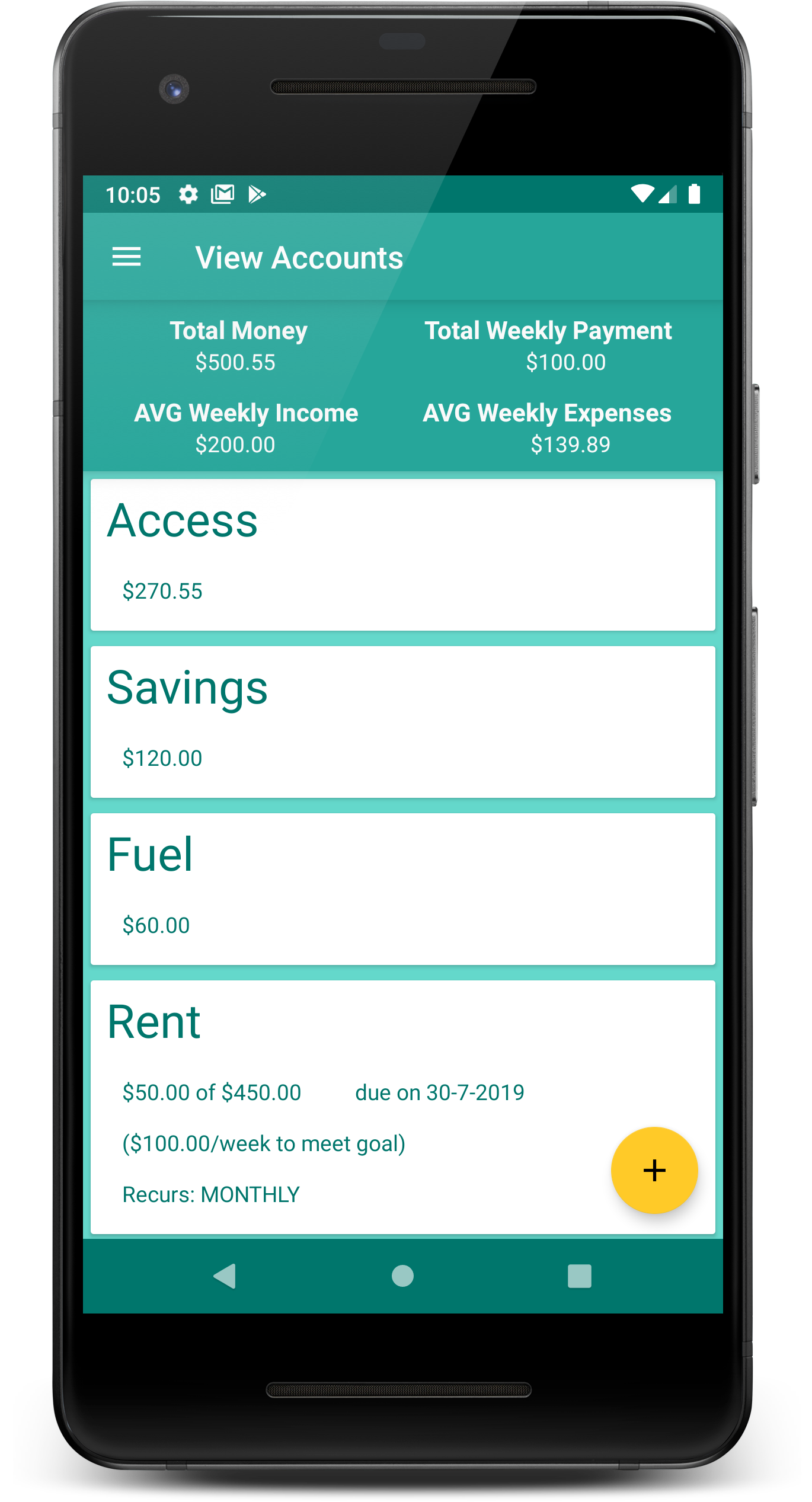

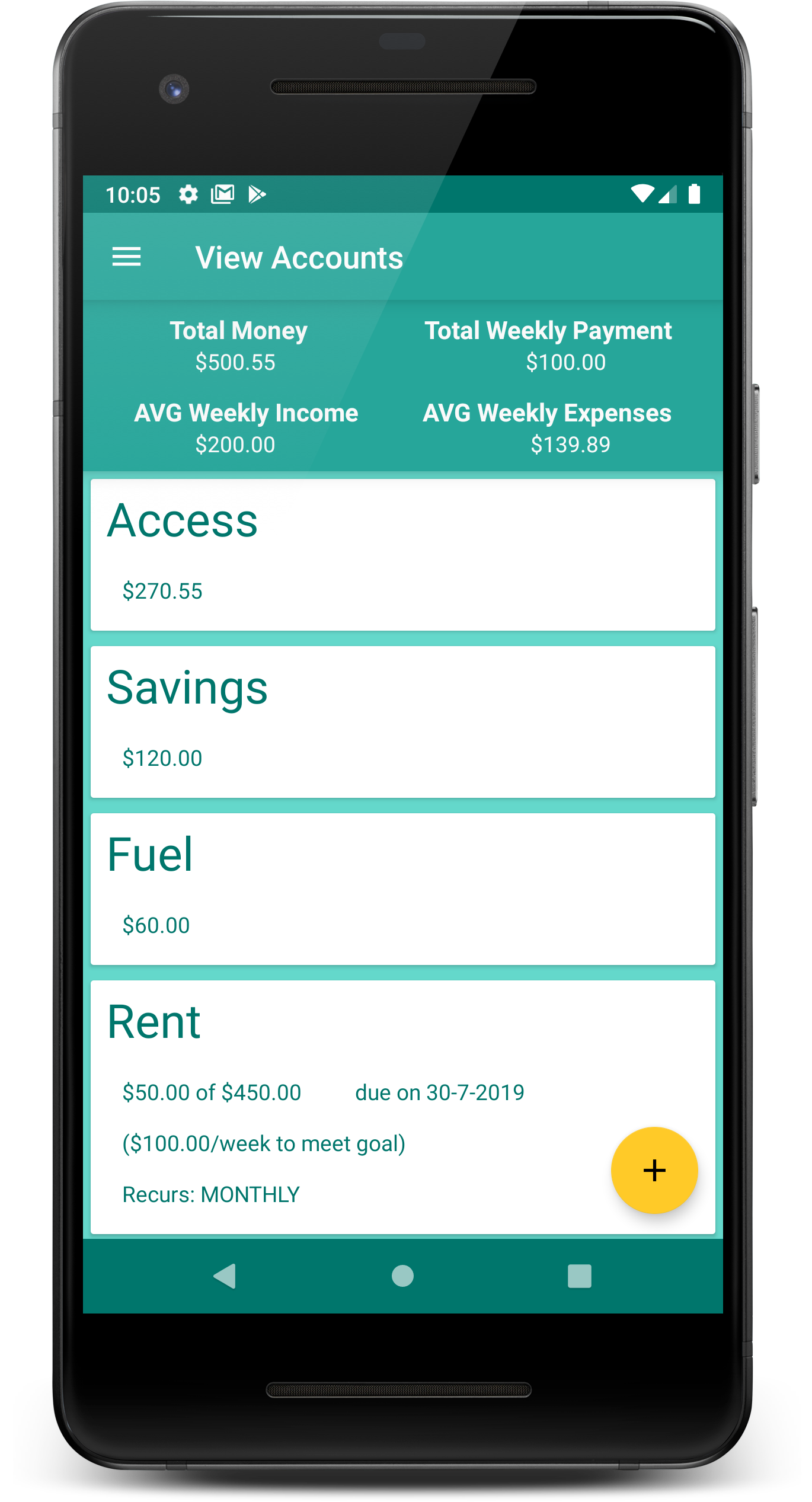

Budget's main focus is using Accounts to manage your money.

From here, your can transfer funds between any of your accounts, so

you can always keep track of where your funds are allocated.

Organising your data into accounts helps you set savings goals and reach them.

Whether you're saving for a holiday, or making sure you have enough aside

to pay the bills, Budget will ensure you stay on track.

From the data in your accounts, Budget will tell you how much total

money you have, how much you need to put away each week, and your

average weekly incomes and expenses.

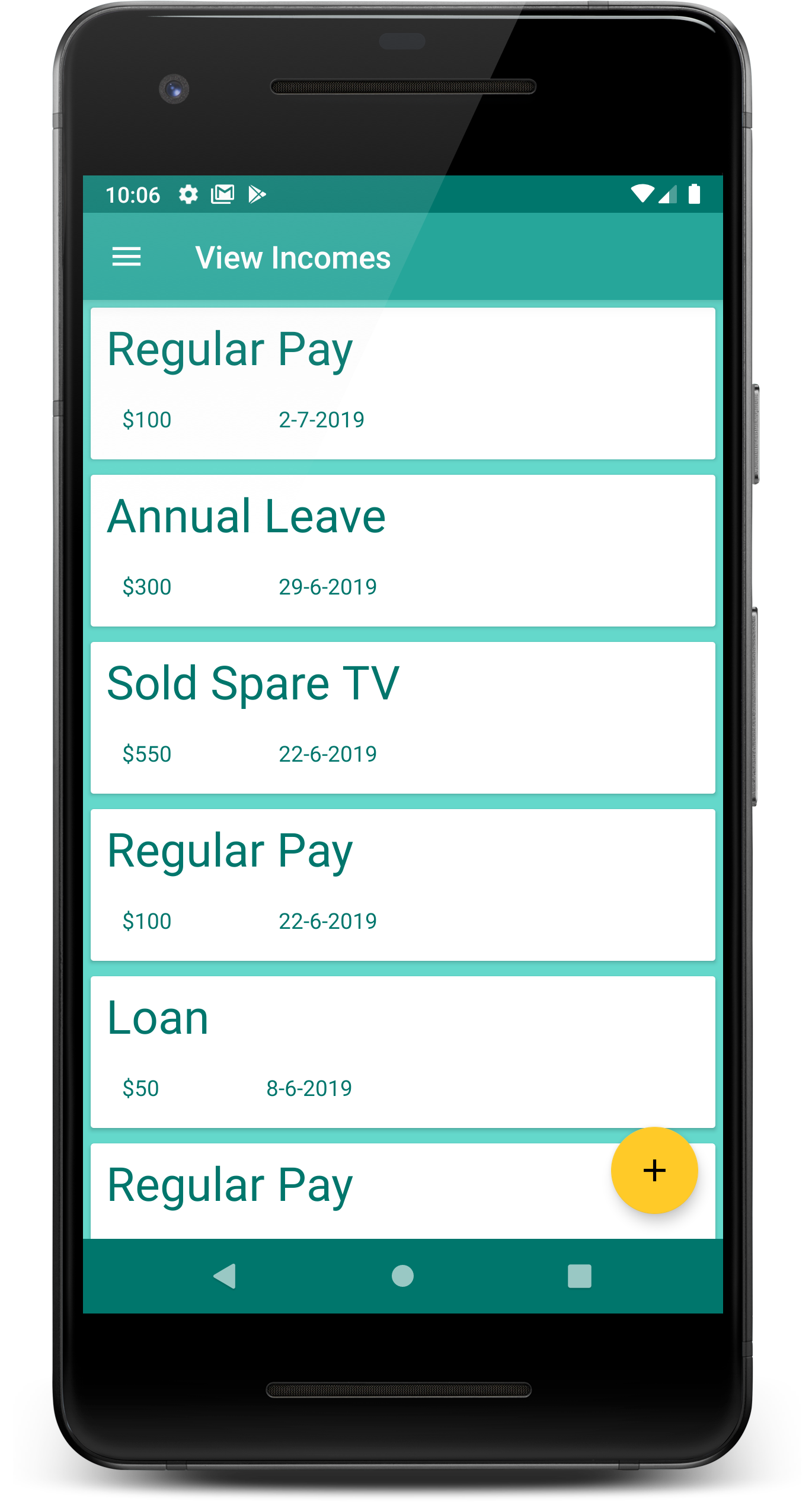

Each time you earn an income, add it into the Budget app.

Budget will automatically put away 10% into your savings account,

helping you build positive saving habits.

Keeping track of

your income allows you to identify major and minor sources of income,

and make the most of them.

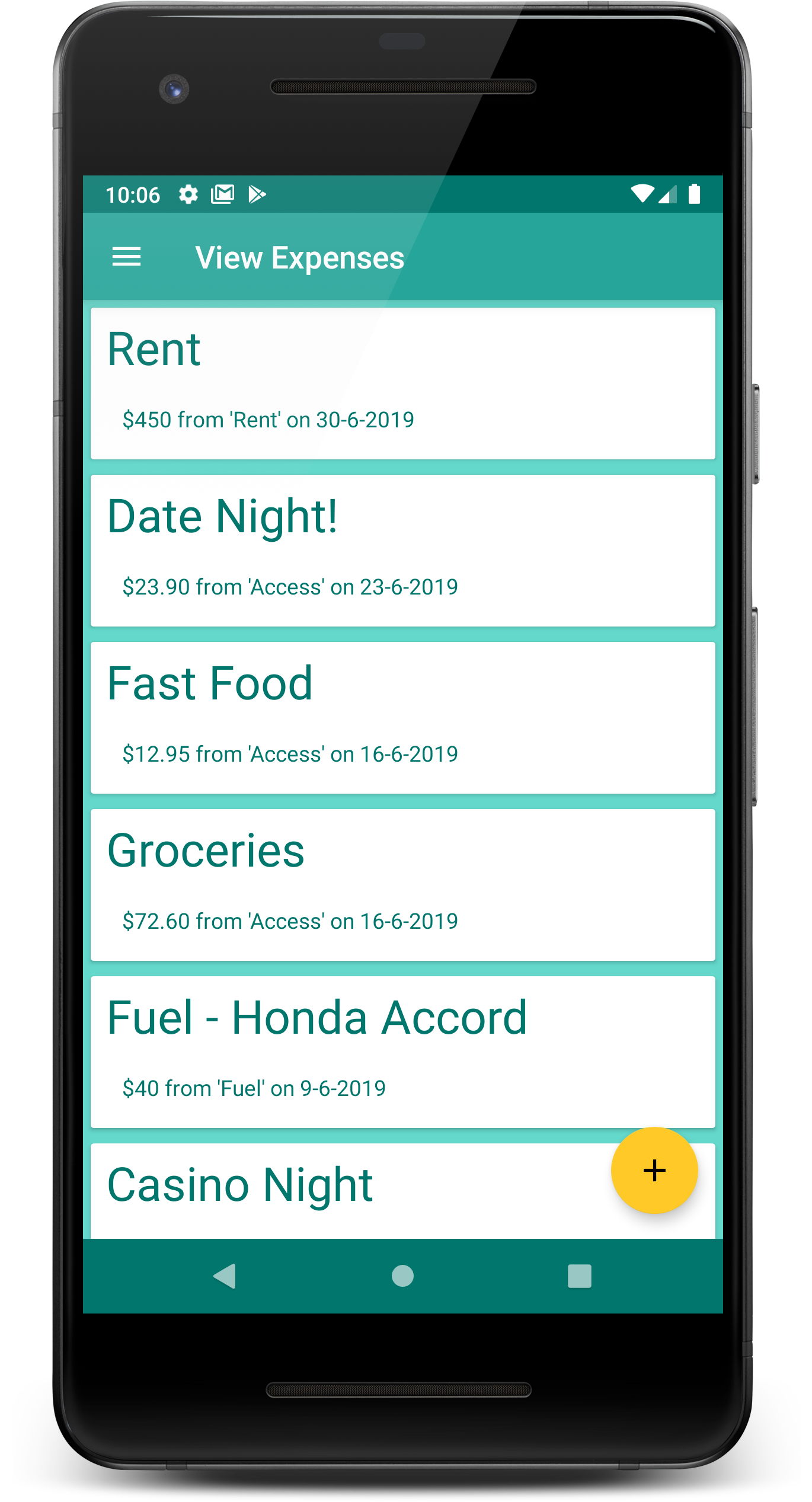

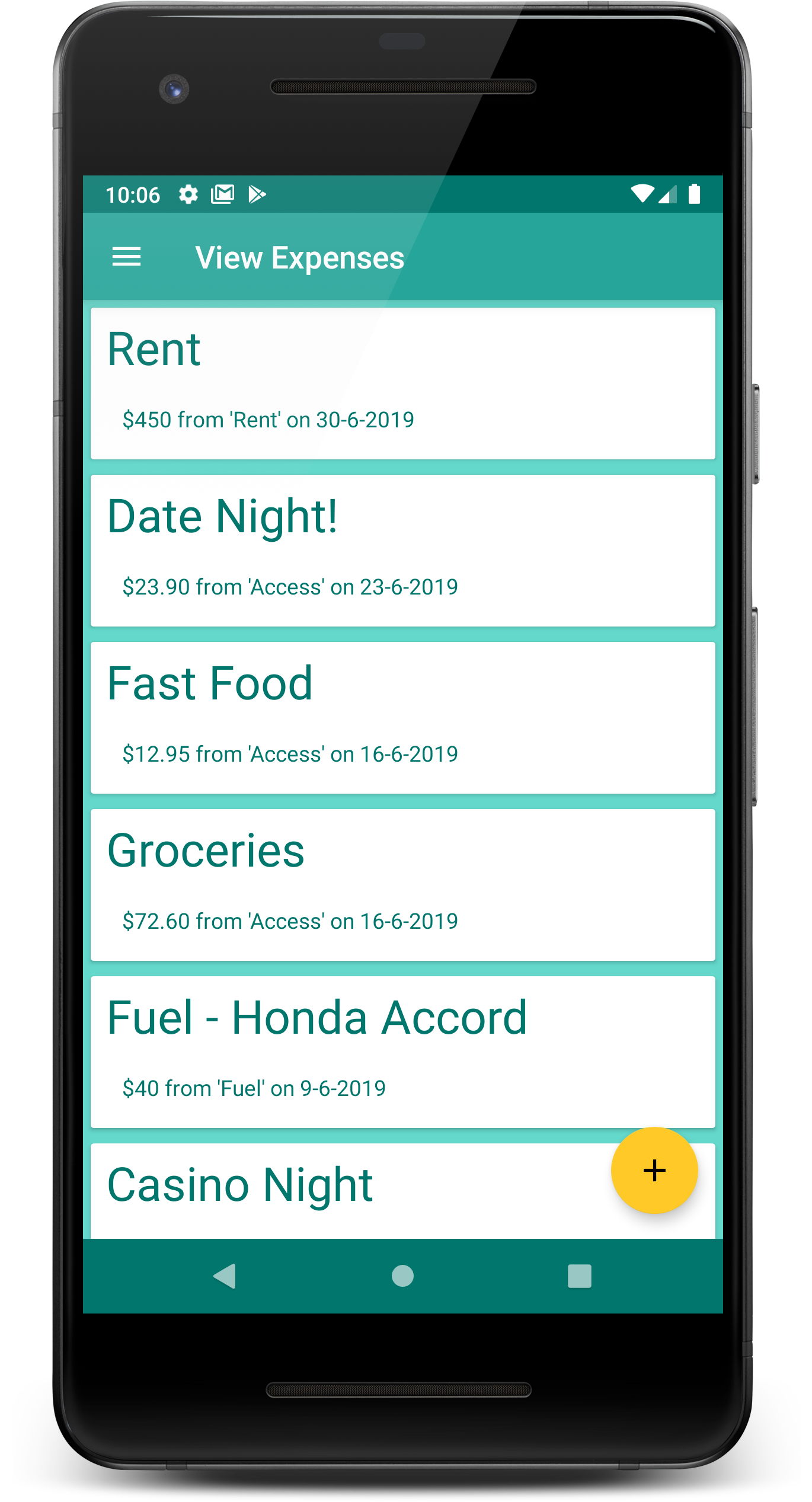

Keeping track of your expenses lets you see exactly where your money is going,

helping you minimise unnecessary expenditure.

Each expense is linked to an account, so you can quickly identify your biggest expenses,

whether it be impulsive fast-food spending, or essential spending on fuel or rent.

Budget will also keep you up-to-date on your average weekly spending, helping you keep

your income greater than your expenses and making sure your savings stay safe.